Estimating vacation rental income is a critical step for property owners looking to maximize their investment. At Up North Property Management, we’ve seen firsthand how accurate income projections can make or break a rental venture.

This guide will walk you through the key factors that influence your potential earnings and provide practical tools to help you estimate your vacation rental income. We’ll also share proven strategies to boost your property’s profitability in the competitive short-term rental market.

What Drives Vacation Rental Income?

Vacation rental income fluctuates based on several key factors that can significantly impact your investment. Properties in Northern Minnesota can achieve remarkable success when owners understand and leverage these drivers effectively.

Location: The Cornerstone of Rental Success

Location dominates the vacation rental market. Properties near popular lakes or ski resorts in Northern Minnesota often command higher rates and enjoy longer booking seasons. Top-performing properties in these areas typically sit on the lake, boast incredible lake views, and/or are located near popular attractions.

Seasonality also plays a pivotal role. In Northern Minnesota, summer months typically see peak demand, with some property owners reporting high occupancy rates from June to August. Winter sports enthusiasts create a second peak season from December to February, especially for properties near ski resorts.

Property Features: What Guests Really Want

The size and amenities of your property significantly impact its earning potential. Properties with hot tubs or saunas can command a premium in nightly rates. Similarly, pet-friendly rentals often see higher occupancy rates, as they cater to a broader market of travelers.

Unique features can set your property apart. A private dock on a popular fishing lake or stunning views of the Northern Lights can allow for premium pricing in a crowded market.

Local Attractions: Leveraging Your Surroundings

The attractions and events in your area can dramatically affect demand. Properties near popular festivals or annual events often see spikes in bookings. Rentals near the Boundary Waters during the peak canoeing season (May to September) can expect high occupancy rates.

Research local calendars and align your marketing efforts accordingly. Highlight nearby attractions in your listing to appeal to specific traveler interests (world-class fishing, hiking trails, or winter sports).

Market Saturation: Standing Out from the Crowd

Understanding your competition is essential. In popular areas of Northern Minnesota, properties with unique offerings or superior marketing can achieve higher occupancy rates than the local average.

To stand out, offer experiences that your competitors don’t. This could include partnering with local guides for exclusive fishing trips or providing complimentary snowshoe rentals in winter. These unique selling points not only justify higher rates but also lead to more repeat bookings.

The vacation rental market constantly evolves, and staying informed about these drivers is key to maximizing your property’s potential. In the next section, we’ll explore the tools and methods you can use to estimate your vacation rental income accurately.

How to Estimate Your Vacation Rental Income

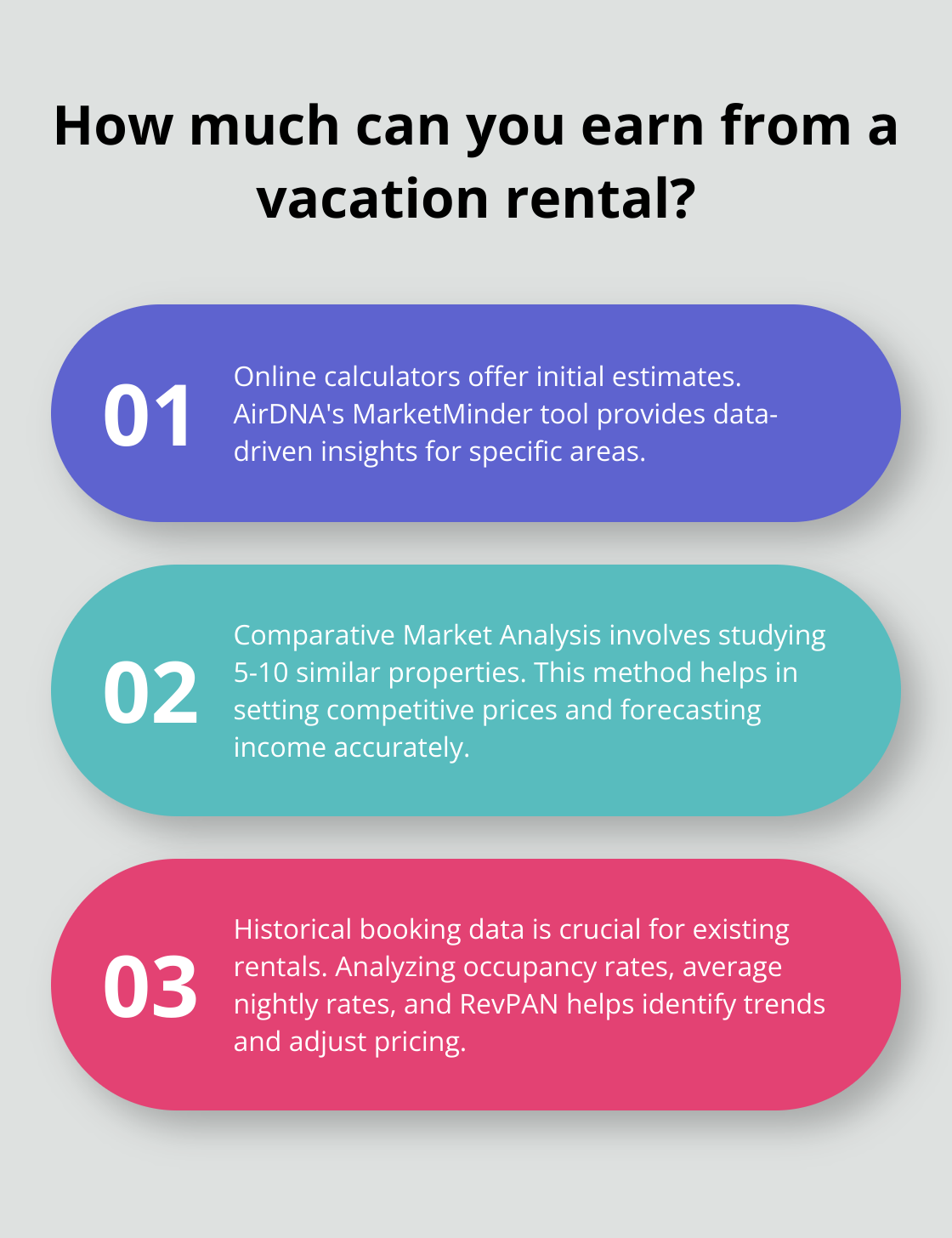

Leverage Online Vacation Rental Calculators

Online vacation rental calculators provide a starting point for estimating your potential income. AirDNA’s MarketMinder tool offers data-driven insights specific to your area. Input your property’s location, size, and amenities to get a ballpark figure of your potential earnings. These tools often provide optimistic estimates and may not account for all local factors, so use them as a general guide rather than a definitive forecast.

Conduct a Thorough Comparative Market Analysis

A comparative market analysis (CMA) offers a more hands-on approach to income estimation. Identify 5-10 properties in your area that match yours in terms of size, amenities, and location. Use platforms like Airbnb and VRBO to track their nightly rates and availability calendars over several months. This method will give you a realistic picture of occupancy rates and pricing trends in your market.

For instance, if you own a 3-bedroom cabin on Gull Lake, search for similar properties in the area and note their rates during peak summer months and quieter shoulder seasons. This approach allows you to set competitive prices and forecast potential income more accurately.

Analyze Historical Booking Data

If you already rent out your property, historical booking data becomes your most valuable asset for future income estimation. Review your past year’s performance, focusing on:

- Occupancy rates by month

- Average nightly rate

- Revenue per available night (RevPAN)

This data will help you identify trends, such as which months are most profitable and when you should adjust your rates. New market entrants can reach out to local property management companies for access to aggregated data that provides insights into market performance.

Consult with Local Experts

While online tools and personal research provide value, local expertise remains unmatched. Professional property managers possess in-depth knowledge of the Northern Minnesota vacation rental market. They can provide accurate income projections based on years of data and experience managing properties in the area.

Local real estate agents who specialize in vacation rentals can also offer valuable insights. They often have access to comprehensive market data and can provide a realistic assessment of your property’s earning potential.

Estimating vacation rental income requires ongoing attention and adjustment. Market conditions change rapidly, and factors like new local attractions or shifts in travel trends can impact your earnings. The next section will explore strategies to maximize your rental income in the dynamic Northern Minnesota market.

How to Boost Your Vacation Rental Income

Implement Dynamic Pricing

Dynamic pricing boosts your overall profit. Adjust your rates based on demand to capitalize on peak periods while maintaining occupancy during slower times. During the Boundary Waters canoeing season (May to September), rates for nearby properties can increase by 30-50%. Properties near ski resorts like Lutsen Mountains command premium prices during winter weekends and holidays.

Use tools like PriceLabs or Beyond Pricing to implement dynamic pricing effectively. These platforms analyze market data and automatically adjust your rates based on factors like local events, weather, and historical booking patterns. By using smart pricing engines, your pricing will be kept competitive 24/7.

Create Irresistible Packages

Set your property apart and justify higher rates with tailored packages. For a lakeside cabin, partner with local fishing guides to offer exclusive guided trips. During winter, team up with nearby ski resorts for discounted lift tickets. A property near Voyageurs National Park saw a 25% increase in bookings after introducing a “Stargazing Package” (including telescope rental and a night sky guide).

Optimize Your Online Presence

Your online presence can make or break your success in today’s digital age. High-quality, professional photos are non-negotiable. Studies have shown that listings with high-quality photos receive more inquiries, bookings, and higher revenue. Showcase your property’s unique features – that private dock, the stunning lake view, or the cozy fireplace.

Craft a compelling property description that highlights nearby attractions and seasonal activities. If your property is near the North Shore, mention the scenic drives, waterfalls, and hiking trails. Be specific – instead of saying “near hiking trails,” say “5 minutes from the famous Superior Hiking Trail.”

Encourage and respond to guest reviews promptly. Properties with 50+ positive reviews often see higher occupancy rates and can command prices up to 10% higher than similar properties with fewer reviews.

Elevate the Guest Experience

Exceptional guest experiences lead to glowing reviews and repeat bookings. Go beyond the basics – provide a “local’s guide” to the area, stock the kitchen with essential cooking supplies, or offer a welcome basket with local treats. A property in Ely saw a 40% increase in five-star reviews after adding a sauna and providing complimentary firewood.

Consider adding unique amenities that align with your location. For a property near the Boundary Waters, provide high-quality camping gear for rent. Near ski resorts? Offer boot warmers and a ski tuning station.

These strategies increase your income and create memorable experiences that keep guests coming back year after year. In the vacation rental market, success involves more than competitive pricing – it’s about creating value that justifies premium rates.

Final Thoughts

Estimating vacation rental income in Northern Minnesota requires a multifaceted approach. Location, property features, local attractions, and market competition all influence potential earnings. Online tools, market analyses, and expert consultations help develop realistic income projections. The vacation rental market changes constantly, so income estimation must adapt to new trends and opportunities.

Regular analysis and adjustment of pricing, marketing, and property offerings maximize returns. As travel preferences evolve and new attractions emerge in Northern Minnesota, property owners must stay informed to capitalize on opportunities. Successful vacation rental management demands ongoing attention to market dynamics and guest expectations.

Property owners can benefit from professional support to navigate the complexities of vacation rental management. Up North Property Management offers comprehensive services for Northern Minnesota properties, from marketing to maintenance. Their local expertise and commitment to guest satisfaction can help owners achieve optimal income while providing memorable experiences for visitors to the Northern Lakes Area.